Blog

Unlocking Investment Potential: The Advantages of Workforce Housing

Bender Companies /26 Mar 2024

The world of real estate investment often leads us down a path lined with choices—some flashy and enticing, others more understated yet rewarding. Workforce Housing falls into the latter category, often overlooked for its lack of glamour and associated challenges. It’s tempting to gravitate towards shiny new Class A multifamily properties with the latest amenities, but is that truly the superior investment? At Bender, we recognize the lasting value of Workforce Housing.

Before we jump into the reasons why we invest in Workforce Housing, let’s address some challenges.

Deferred Maintenance & Capital Improvements

Investing in vintage Workforce Housing assets requires a well-structured and adequately funded Cap Ex strategy. These properties often require significant capital infusion to bring them back to life or at a minimum, maintain them throughout the investment period. Historically, our Cap Ex budget has ranged from 3% to 20% of the total purchase price, with an average of around 7-8%. When dealing with older vintage properties, you want to make sure you have enough money set aside to handle those inevitable repairs and replacements. Without funds set aside, you could find yourself in a tough spot down the road, putting your investment at serious risk.

Increased Delinquency

Underwriting delinquency requires a nuanced approach. Understanding the market and being realistic with the percentage of bad debt you’re underwriting is crucial. At Bender, we choose markets to invest in with stronger area median incomes, lower unemployment rates, and diversified economies. Within our portfolio, bad debt ranges from 0% to 4%, depending on the location and property. It’s important to understand the market level of delinquency going into the deal as it can vary drastically by location. Implementing a strong tenant screening process and having a consistent approach to collecting rent, play a big role in lowering delinquency.

Higher Expenses & Ongoing Costs

Keeping up with repairs on older Workforce Housing can put a strain on cash flow. Understanding the type and condition of building systems – Plumbing, electrical, HVAC, roofing, parking lots, windows, etc. – is key to accurately budgeting for replacements and ongoing maintenance. While the seller’s financials provide some insights, conducting thorough due diligence is key to uncovering potential issues. By budgeting for replacements upfront, you can ultimately save money on ongoing repairs down the line.

With any investment there are risks and challenges. At Bender, we feel that Workforce Housing provides the best risk vs reward. There are many reasons why we choose to invest in Workforce Housing, but a few stand out above the rest.

Supply & Demand Dynamics

The supply and demand dynamics of Workforce Housing are one of the primary reasons we find this segment of housing such an appealing place to invest. Workforce Housing is challenging to develop because the math often doesn’t work out – construction costs are too high, and rents are too low. Consequently, the threat of new supply entering the market is limited.

People are searching for affordability and it’s becoming harder and harder for renters to find something that fits their budget and has functionality and/or the amenities they want. According to the 2022 Census data, the median household income in America was $74,580 and just over 50% of households are making less than $75,000. Using the 30% rent to income rule of thumb, means most households can only afford about $1,850/month in rent. The average market rent in our portfolio today is around $1,200/m. This puts us in a great spot to cater to a wide range of potential renters.

Cost Basis

The well-known saying “Location Location Location” in Real Estate has been around for generations. I’ll add to that with “Basis Basis Basis”. Of course, location is important, but overall cost basis is arguably the most important metric when investing in Real Estate. If you buy the property at a great price, you’ll probably do well with the investment.

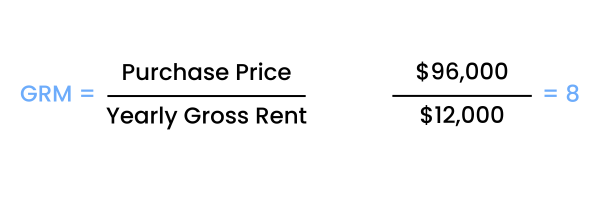

A good way to quickly get a feel for the basis or pricing of a deal is Gross Rent Multiplier (GRM). For example, if your average rent is $1,000/month or $12,000/year, depending on the vintage and market, we’re looking for a GRM of 8x or less, meaning $96,000 purchase price per unit or less ($12,000 yearly rent x 8= $96,000.). When analyzing potential new acquisitions, we’re hyper focused on not only our basis going into the deal, but also how realistic our underwritten exit price is. We want to be cognizant of what the basis might look like on the back end for a new buyer and confident that it will be achievable. One of the ways we determine that both our going-in basis and exit is defensible is through analyzing recent sales of similar properties in the market.

Multiple Ways to Add Value

When we invest in a property, it’s not about following the seller’s lead; it’s with the belief that we can implement new strategies to enhance its value. We enter with a clear business plan aimed at boosting NOI and adding value. Unlike new construction deals, where opportunities for growth may be limited to lease-up periods or organic rent increases, middle-market Workforce Housing offers a wealth of possibilities. These deals often present numerous avenues for value enhancement, providing us with the flexibility to adapt and remain agile in our approach.

Some strategies we use at Bender to add value are:

- Naturally under market rents where we can use a mark to market strategy

- Ancillary revenue opportunities – Utility reimbursement income, pet charges, move-in fees, etc.

- Cost reduction strategies – We look to capitalize funds upfront to take care of deferred maintenance and look at utility savings programs

- Top line revenue growth through unit renovations

Sourcing mismanaged, underperforming, and undercapitalized deals provides us with the ability to implement the strategies mentioned above. We love to buy from mom-and-pop owners, long term ownership, and out of state/nonlocal sponsors without economies of scale in the market, as these deals often present the greatest potential for upside.

In the world of Real Estate investing, it’s important to remember properties don’t need to be flashy and shiny to yield substantial returns. Workforce Housing provides investors with strong cash flow, opportunities to add value, and limited risk of new supply. While each deal is unique, these inherent strengths make Workforce Housing an attractive option for long-term investment. At Bender, we recognize the intrinsic value of Workforce Housing assets and we’ve built our business around investing in these types of properties.

By Kurt Bender, Founder & Principal

YOU MIGHT ALSO LIKE...

Investing Investing / 26 Mar 2025

Bender Companies Enters Nebraska Market with Acquisition of The Colonial Apartments

Investing Investing / 31 Jan 2025

Bender Companies Acquires 550-Unit Apartment Community in Hoffman Estates, IL

Investing Investing / 10 Sep 2024